Bitcoin Hovers at $85K as Fed’s Waller Suggests 'Bad News' Rate Cuts if Tariffs Resume

Bitcoin Hovers at $85K as Fed’s Waller Suggests 'Bad News' Rate Cuts if Tariffs Resume

U.S. stocks, including Strategy (MSTR) and MARA Holdings, rose on possible progress on trade talks with the EU.

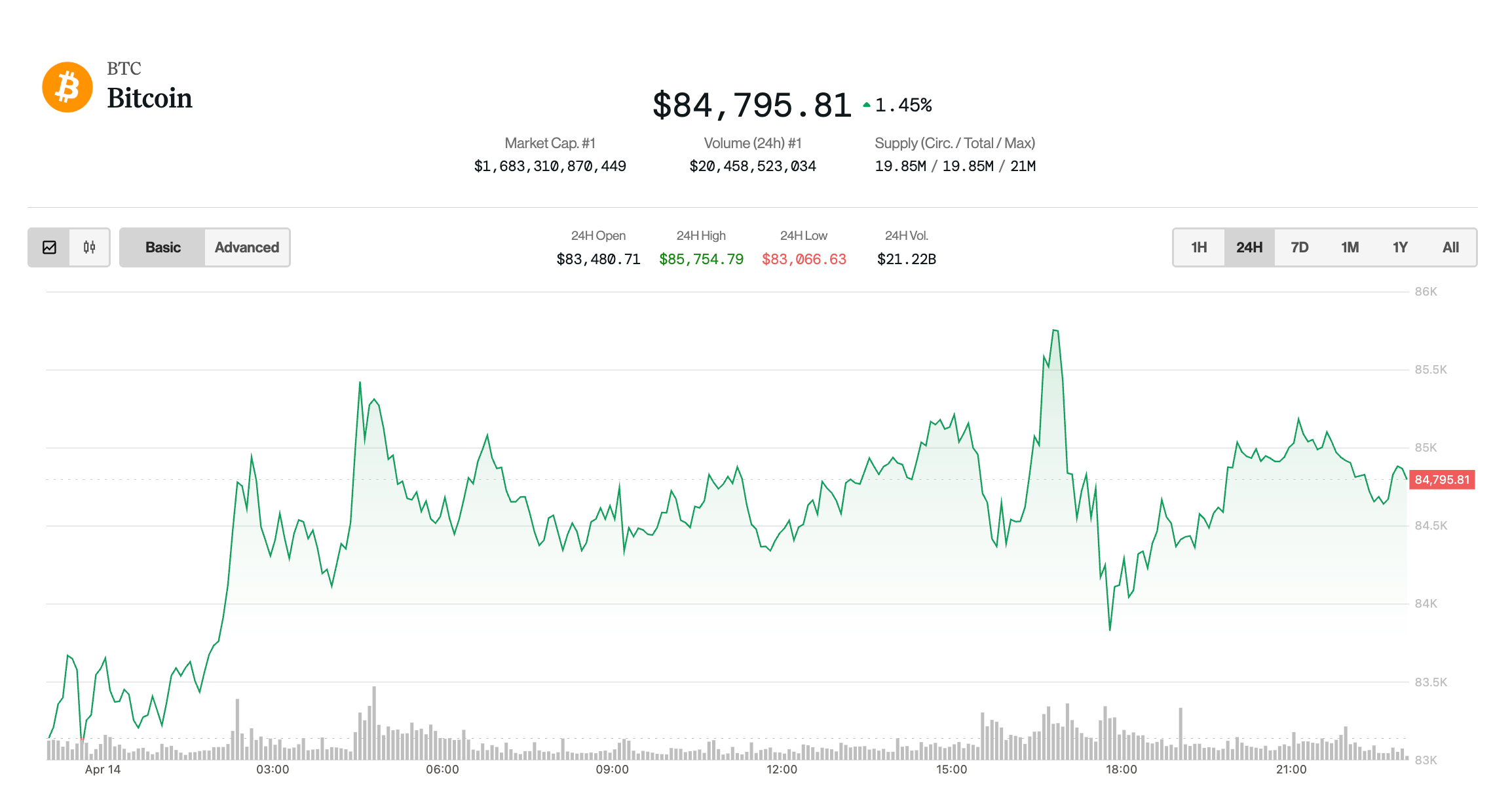

- Bitcoin edged higher to near $85,000 as improving market sentiment and trade negotiations eased investor concerns. The CoinDesk 20 Index climbed 1.2%, driven by gains in SOL and AVAX.

- Federal Reserve Governor Christopher Waller indicated potential rate cuts if Trump tariffs return, while the EU delayed retaliatory tariffs on U.S. goods.

- Swissblock analysts highlighted Bitcoin’s strengthening network fundamentals and stabilizing liquidity as signs of potential sustained growth.

Bitcoin is holding steady around $85,000 as the Federal Reserve's Christopher Waller hints at potential rate cuts in response to a resumption of tariffs. In positive news, U.S. stocks like Strategy (MSTR) and MARA Holdings surged amid optimistic trade talks with the EU.

Market sentiment improved, lifting Bitcoin close to $85,000 and driving the CoinDesk 20 Index up by 1.2%, thanks to gains in SOL and AVAX. Waller's comments on rate cuts if tariffs return coincided with the EU postponing retaliatory tariffs on American products.

Swissblock analysts praised Bitcoin’s robust network fundamentals and stable liquidity as indicators of possible sustained growth. The stock market also advanced, with Nasdaq rising by 0.6% and S&P 500 by 0.8%. Notably, Strategy (MSTR) and MARA Holdings (MARA) led crypto stocks with approximately 3% gains.

Waller warned that a reintroduction of Trump's punitive tariffs could necessitate significant rate cuts. He stated that such tariffs could have enduring effects on output and employment, potentially impacting monetary policy decisions. European Commission has delayed imposing retaliatory tariffs worth €21 billion on U.S. goods until July 14 to facilitate negotiations.

The likelihood of a trade agreement between the U.S. and EU surged to 65% on Polymarket following reports of ongoing discussions between President Donald Trump and EU officials. Bitcoin's price momentum paused around $85,000, but SwissBlock Technologies highlighted improving network fundamentals as reasons for optimism about future growth prospects.

Bitcoin fundamentals recovering

New participants joining since March have stabilized liquidity, reducing the extreme price swings seen earlier this year according to Swissblock analysts who underscored this stability as crucial for sustainable market rallies ahead.

"Since March, we’ve seen a consistent inflow of new participants," Swissblock analysts wrote in a Telegram broadcast. "Liquidity is stabilizing, no more erratic swings from early 2025."

"This is the kind of structural support that underpins sustainable rallies," they concluded.