Bitcoin in Standstill at $85K as Trump Increases Pressure on Fed's Powell

Bitcoin Price Holds at $85K Amid Trump's Pressure on Fed Chair Powell

Recent developments in the U.S. economy have sparked concerns about stagflation as the Philadelphia Fed manufacturing index plunged, accompanied by escalating prices due to the ongoing tariff war.

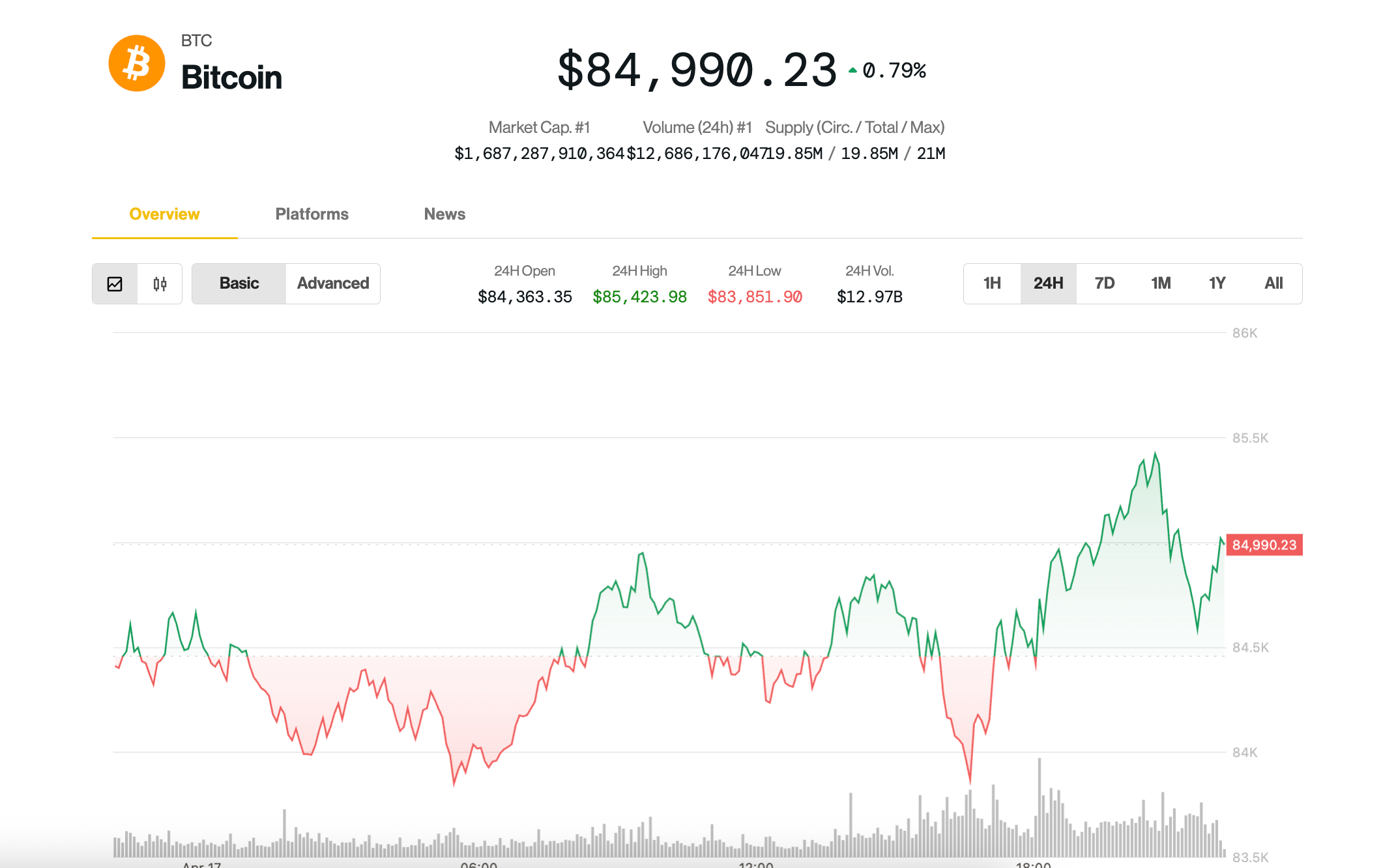

Bitcoin maintained stability around $85,000, with cryptocurrencies like BCH, NEAR, and AAVE leading gains on the CoinDesk 20 Index. Speculation arose following reports of President Trump considering dismissing Fed Chair Jerome Powell, igniting worries about market stability and the autonomy of the central bank.

According to Deribit data, Bitcoin options traders are currently favoring bullish bets ranging from $90,000 to $100,000 while hedging against potential short-term declines.

Bitcoin in Standstill at $85K as Trump Increases Pressure on Fed's Powell

A sharp plunge in the Philadelphia Fed manufacturing index coupled with rising prices added to U.S. stagflation fears amid the tariff war.

- Bitcoin stabilized around $85,000, while the CoinDesk 20 Index was led higher by gains in BCH, NEAR and AAVE.

- President Trump reportedly has been privately discussing firing Powell, raising concerns about market stability and central bank independence.

- Bitcoin options traders are chasing bullish, $90k to $100k bets, while seeking protection from a potential decline in the near term, Deribit data shows.

Powell's recent critical remarks regarding Trump's tariff policies hint at a more cautious approach from the Fed towards inflation. Despite being appointed by both Trump and Biden for a second term until 2026, Powell faces increasing pressure from Trump to step down, with former Fed Governor Kevin Warsh potentially waiting in line as his replacement.

The uncertainty surrounding Powell's position has rattled markets. The likelihood of him being ousted this year spiked to 19%, reflecting growing concerns among investors. This comes amidst challenges in Europe too as the ECB continues its rate cuts amid deteriorating economic prospects.

The latest blow to market confidence came from the Philadelphia Fed manufacturing index plummeting to a two-year low while prices surged significantly. These developments coupled with dovish signals from ECB and hawkish comments from Powell have fueled fears of stagflation within the U.S.

Against this backdrop, bitcoin traders are cautiously positioning themselves in anticipation of market volatility. Traders on Deribit are actively engaging in options trading with calls between $90k-100k expiring in May and June signaling optimism for further price upticks. Simultaneously, there is interest in buying put options at $80k for downside protection underscoring a balanced risk management strategy during uncertain times. The heightened fear in financial markets is evident through sustained high levels of Wall Street’s fear gauge VIX despite recent declines from its peak above 50.

Odds of Trump removing Powell this year on the blockchain-based prediction market Polymarket rose to 19%, the highest reading since the contract's late January launch.

Trump's comments came on the back of the European Central Bank (ECB) cutting key interest rates for the seventh consecutive occasion on Thursday as it warned of a deteriorating growth outlook.

More pressure on markets came from the latest Philadelphia Fed manufacturing index, published Thursday morning, which showed a nosedive in activity this month, sinking to its lowest level (-26.4) in two years. Meanwhile, the prices paid index climbed to its highest reading since July 2022, adding to concerns about the Trump administration's large-scale tariff policy pushing the U.S. economy into stagflation.

The S&P 500 and tech-heavy Nasdaq stock indexes traded mostly flat during the day.

How bitcoin traders position amid heightened fear on Wall Street ?

Bitcoin has stabilized between $83k and $86k with traders chasing bullish bets while still seeking downside protection.

On Deribit, traders are actively chasing calls at the 90k to $100k strikes expiring in May and June, the exchange said in a market update Thursday. The demand for calls indicates expectations for a continued price rally.

Some of these bullish bets have been funded by premiums collected by selling put options.

At the same time, there has been renewed interest in buying put options at $80k expiring this month, representing preparations for potential price declines. Buying a put option is akin to purchasing insurance against price slides.

The diverse two-way flow comes as the VIX, Wall Street’s fear gauge measuring the 30-day implied volatility, still remains well above its 50-day average, despite the pullback from recent highs above 50.