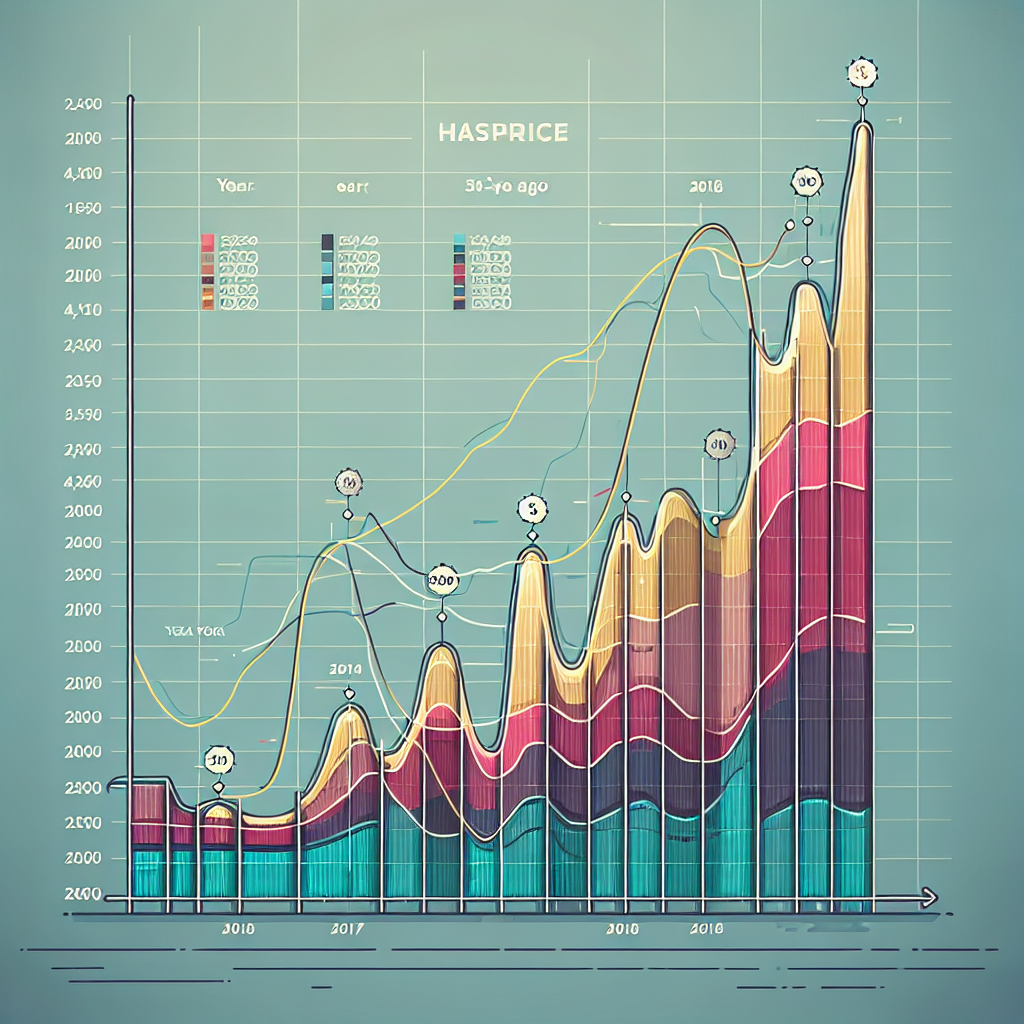

Chart of the Week: 'Dire Picture' for BTC Miners as Revenue Flatlines Near Record Low

Chart of the Week: 'Dire Picture' for BTC Miners as Revenue Flatlines Near Record Low

Despite bitcoin trading around $84,000, miner revenue has decreased due to the recent halving event and rising operational costs.

- Hashprice, a key metric for miner revenue, is near a five-year low, highlighting the challenges in the mining industry.

- Despite bitcoin trading around $84,000, miner revenue has decreased due to the recent halving event and rising operational costs.

- The Valkyrie Bitcoin Miners ETF has dropped 50% year-to-date, reflecting the difficult conditions for miners.

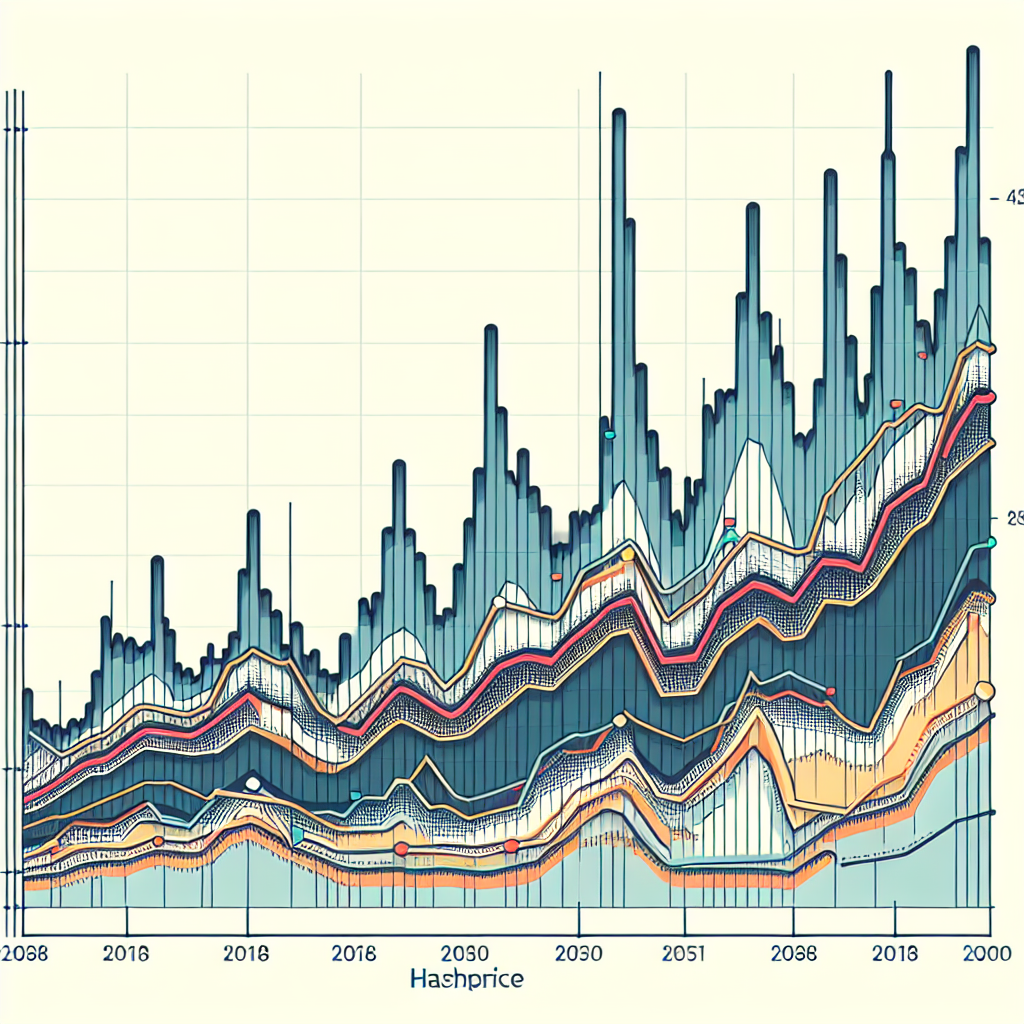

Bitcoin miners are facing a tough time as their revenue has hit a record low despite high bitcoin prices. The current hashprice, a crucial factor in determining miner revenue, is at its lowest in five years, indicating the challenges plaguing the mining sector.

With hashprice currently at $44.00 PH/s, just slightly better than the low in August 2024 when bitcoin was at $49,000, and now trading around $84,000, miners are finding it hard to maintain profitability due to increased operational costs post the recent halving event.

The Valkyrie Bitcoin Miners ETF has seen a significant 50% drop this year alone due to these challenging conditions for miners.

While the situation seems grim, there's still hope for miners to break even at these hashprice levels depending on their mining equipment. However, compared to the prosperous mining period of 2021, profitability remains elusive.

Looking forward, factors like market deterioration and geopolitical uncertainties could further impede mining operations. As a response to these difficulties, many miners are exploring alternative revenue streams like diverting computing power towards artificial intelligence applications.