Figment Eyes Up to $200M Worth of Acquisitions in Crypto M&A Push: Report

With only a week to go, Figment is intensifying its search for potential acquisitions in the crypto space, eyeing deals worth up to $200 million. The company is specifically interested in players within the Solana and Cosmos networks, aiming at regional entities. This move aligns with the current favorable U.S. cryptocurrency policies that are propelling merger and acquisition activity in the sector.

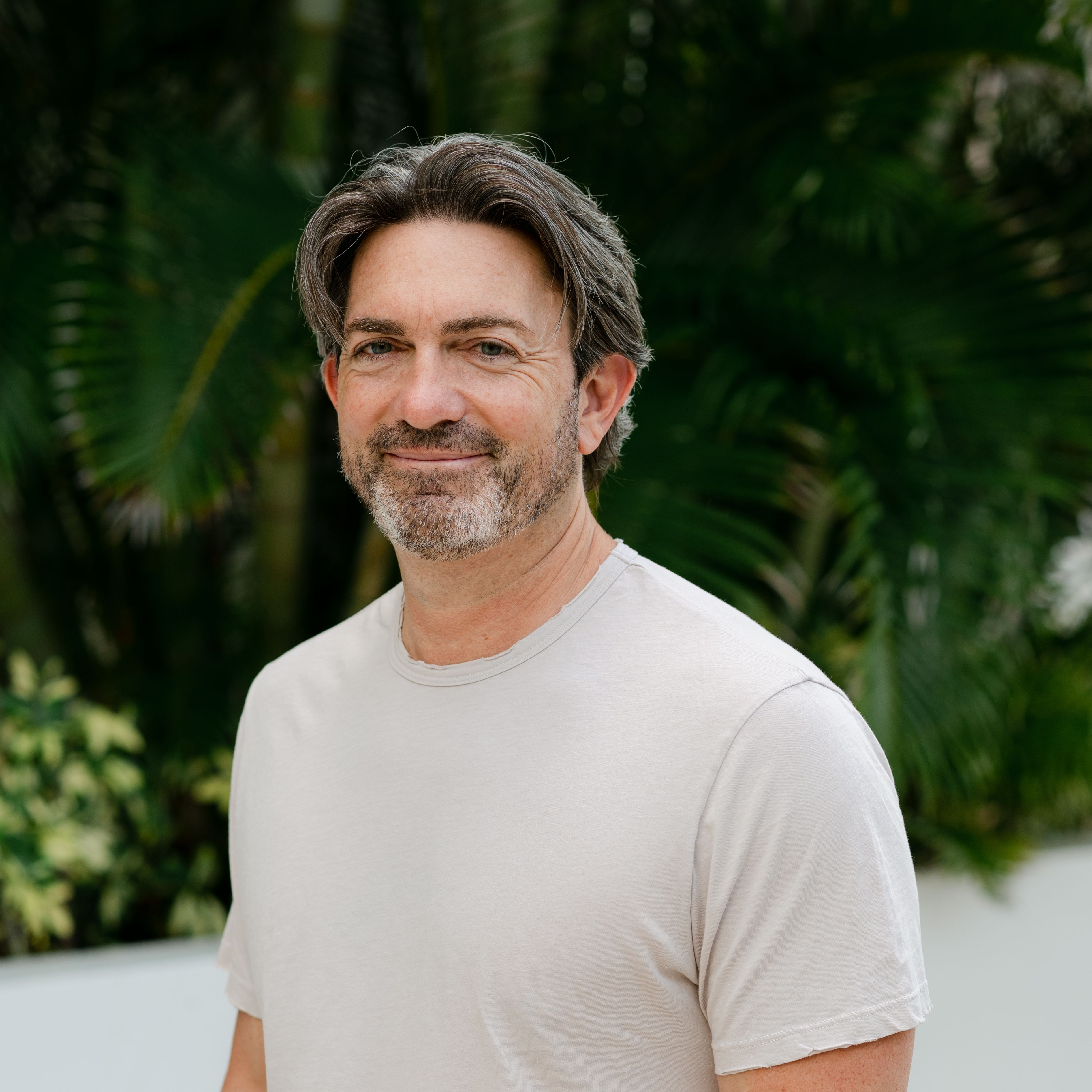

Figment's CEO, Lorien Gabel, revealed that they have active term sheets in circulation and are concentrating on acquiring companies ranging between $100 million to $200 million. Specializing in helping institutions generate returns through staking activities, Figment manages over $15 billion in staked assets with a workforce of approximately 150 employees.

The surge of crypto-related transactions includes notable deals like Kraken's acquisition of NinjaTrader for $1.5 billion and Ripple's purchase of Hidden Road for $1.25 billion. These activities have coincided with a more crypto-supportive regulatory climate under the Trump administration, as seen by dropped cases against various crypto firms by the U.S. Securities and Exchange Commission.

Despite their ambitious acquisition agenda, Figment has no plans to seek additional funding or entertain offers for sale. Gabel expressed his dedication to the long-term growth of Figment, emphasizing a commitment that extends beyond financial gain. The company has amassed $165 million in funding so far, with big names like Thoma Bravo leading their recent Series C round alongside investors such as Morgan Stanley and Franklin Templeton India.

For those following Figment's journey closely, there are only two articles left to read this month before diving deeper into the captivating world of crypto mergers and acquisitions!

Figment Eyes Up to $200M Worth of Acquisitions in Crypto M&A Push: Report

Figment is targeting regional players on Cosmos and Solana networks at a time in which pro-crypto U.S. policy is fueling dealmaking

- Figment is pursuing acquisition targets in the $100 million to $200 million range.

- The company is focusing on players with a strong regional focus and on blockchains including Solana and Cosmos.

- CEO Lorien Gabel says the firm has active term sheets out and is not looking to raise capital.

Figment helps institutions earn yield by staking, whereby tokens are locked to help secure blockchain networks and validate transactions supported by networks. The company currently manages around $15 billion in staked assets and employs about 150 people, Gabel said.

The flurry of crypto deals, which include Kraken’s $1.5 billion purchase of NinjaTrader and Ripple’s $1.25 billion acquisition of Hidden Road, comes as the Trump administration brought on a more crypto-friendly regulatory environment. That environment saw the U.S. Securities and Exchange Commission drop cases against various crypto firms, with crypto ally Paul Atkins recently taking over the commission.

Despite the acquisition strategy, Figment isn’t seeking additional funding and has ruled out a sale. Gabel, who co-founded the firm and has launched three prior startups, said he’s committed to building Figment for the long term. “I’d rather go to zero,” he said.

The company has raised $165 million to date, according to data from TheTie. Its latest Series C funding round was led by Thoma Bravo and saw participation from giants including Morgan Stanley, StarkWave, and Franklin Templeton India.

Read More: Kraken to Buy NinjaTrader for $1.5B to Enter U.S. Crypto Futures Market