Jim Chanos is Buying Bitcoin and Shorting Strategy

Jim Chanos is Buying Bitcoin and Shorting Strategy

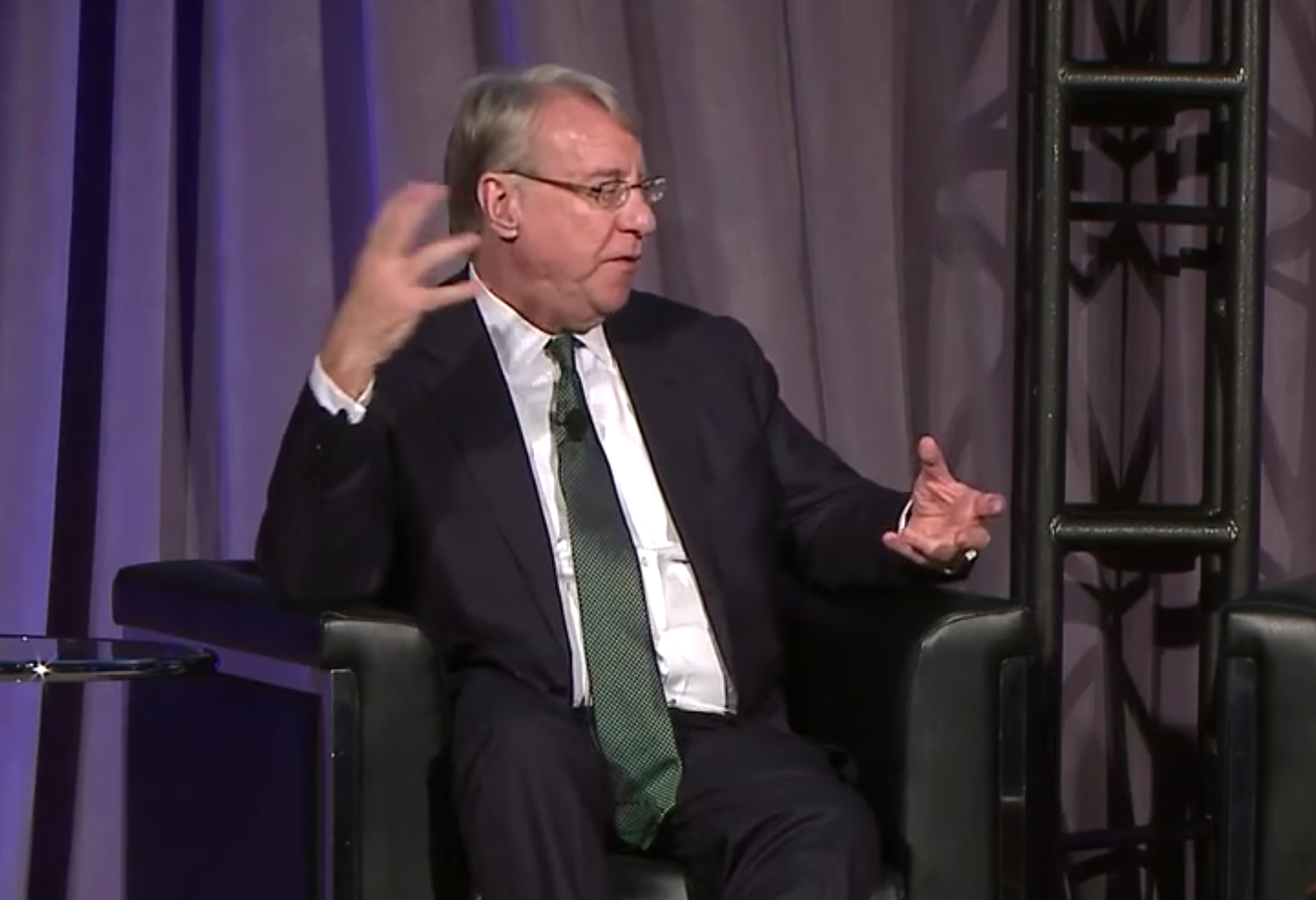

Investor Jim Chanos says Strategy overvalued and is backing bitcoin directly in a long-short strategy

- Jim Chanos is long bitcoin and short Strategy, betting on the valuation gaps.

- Strategy trades at a premium due to its leveraged bitcoin holdings, he argued.

- Chanos views the company’s valuation as a ‘good barometer’ of retail speculation.

Renowned investor Jim Chanos is taking an interesting stance on Bitcoin and a company named Strategy. He is opting to go long on Bitcoin while shorting Strategy, believing that the latter is overvalued. His strategy involves capitalizing on the valuation differences between the two assets.

Chanos highlights that Strategy's premium valuation is primarily due to its highly leveraged exposure to Bitcoin. He considers the company's value as a significant indicator of retail investors' speculative behavior.

The recent surge in Strategy’s stock price can be attributed to its substantial accumulation of Bitcoin, a move that has tied its performance closely to market sentiment towards both Bitcoin and risk appetite. Over the past five years, Strategy's shares have skyrocketed by an impressive 3,500%, currently trading at $416 each with a total market capitalization of $115 billion.