Stabledollars: The Third Act of Dollar Reinvention

1 week to go!

The advent of Stabledollars marks the third revolutionary phase in the evolution of the U.S. dollar, powered by blockchain technology. In a thought-provoking perspective shared by John deVadoss, embracing this innovation strategically is paramount for unlocking the vast potential it offers.

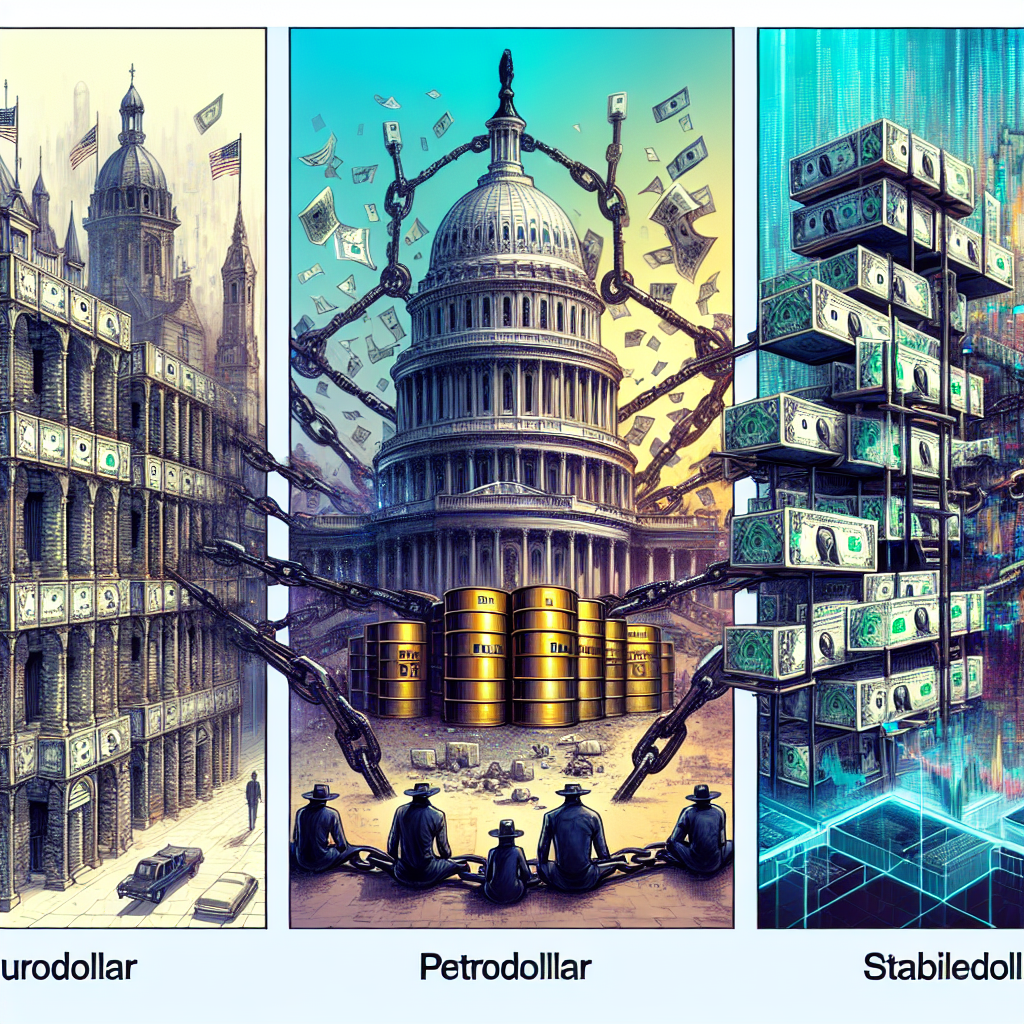

Historically, the dollar's journey unfolds like a captivating three-act play. Act I introduces the Eurodollar era, where off-shore bank deposits emerged in 1950s London as a means for various entities to hold dollars beyond U.S. regulations. Act II witnesses the rise of Petrodollars post-1974 when OPEC's decision to price crude oil in dollars solidified global energy demand tied to the U.S. currency.

Presently, Act III is underway with the emergence of Stabledollars or stablecoins—digital tokens backed by USD and collateralized by T-bills and cash. Their circulating supply has surged past $230 billion, outperforming transactions settled daily by major financial services providers like PayPal and Western Union combined. This modern iteration of the dollar operates as a monetary API, offering seamless and cost-effective transaction capabilities.

The future landscape shaped by these innovations promises transformative opportunities: from improved efficiency in cross-border trade for merchants in Lagos to enhanced investment avenues for Singaporean hedge funds and greater financial freedom for gig workers in Colombia.

Stabledollars: The Third Act of Dollar Reinvention

Blockchain-based dollar infrastructure holds enormous opportunities for the U.S. But only if it treats the technology wisely, says John deVadoss.

Rather than replacing traditional banking systems, stablecoins have pioneered a more efficient route around their sluggish and costly processes.

Proposed legislative measures such as the GENIUS Act aim to charter stablecoin issuers nationally while opening doors to Fed master accounts—a move that could see a substantial expansion of stablecoin circulation over the next decade.

Key strategies outlined include enforcing robust regulatory frameworks on issuers, ensuring transparent collateral through real-time attestations on-chain, promoting cross-blockchain interoperability to avoid monopolies, and offering FDIC-like protection on tokenized deposits akin to traditional bank accounts.

By heeding these recommendations, the U.S. can fortify its position with a digital-dollar framework far superior to any potential competition globally including China's CBDC initiative. Failure to act decisively risks losing control over an increasingly influential financial ecosystem.

Embracing Stabledollars represents another strategic stride in aligning dollar hegemony with prevailing economic currents: Eurodollars financing post-war reconstruction; petrodollars fueling growth during the fossil-fuel era; and now Stabledollars facilitating transactions within our rapidly evolving software-driven economy.

Looking ahead ten years from now, these advancements may seamlessly integrate into everyday life without drawing much attention—a ubiquitous medium for conducting transactions across various currencies and asset classes alike.

With just 2 articles left this month!

The playbook is straightforward:

- Impose Basel-style capital and liquidity rules on issuers.

- Post real-time reserve attestations on-chain so collateral is transparent by default.

- Mandate inter-operability across blockchains to prevent winner-take-all custodianship.

- Extend FDIC-like insurance to tokenized deposits so end-users enjoy the same safety net as with bank accounts.

Do that, and the United States creates a digital-dollar moat wider than any rival’s CBDC, including China’s. Shrug, and issuance will migrate offshore, leaving Washington to police a shadow system it no longer controls.

Dollar hegemony has always advanced by hitching itself to the dominant trade flow of the age: Eurodollars financed post-war reconstruction; petrodollars lubricated the fossil-fuel century; Stabledollars are wiring the high-velocity, software-eaten economy.

Ten years from now, you won’t see them; they will simply be the water we swim in. Your local café will quote prices in pesos or pounds but settle in tokenized dollars under the hood. Brokerages will sell “notes” that are really bearer instruments programmable for collateral calls. Payroll will arrive in a wallet that auto-routes savings, investments, and charitable gifts the instant it clears.